Monochrome introduces IBTC Adviser Program, fee rebate to in-specie subscriptions to IBTC: Monochrome Bitcoin ETF

Monochrome Asset Management have announced the launch of its IBTC Adviser Program, along with a rebate of its management fee for eligible investors who apply in-specie to the Monochrome Bitcoin ETF (Ticker: IBTC) until Dec 31, 2024.

The Monochrome Bitcoin ETF is Australia’s first ETF to hold bitcoin directly under a retail crypto-asset Australian Financial Services License (AFSL) authorisation and is the only dual-access Bitcoin ETF available in the country.

The retail crypto-asset licensing framework ensures robust investor protection rules, encompassing aspects such as crypto custody, benchmarking, and digital asset management expertise.

Full Management Fee Rebate for In-specie Subscriptions (eligible investors only)

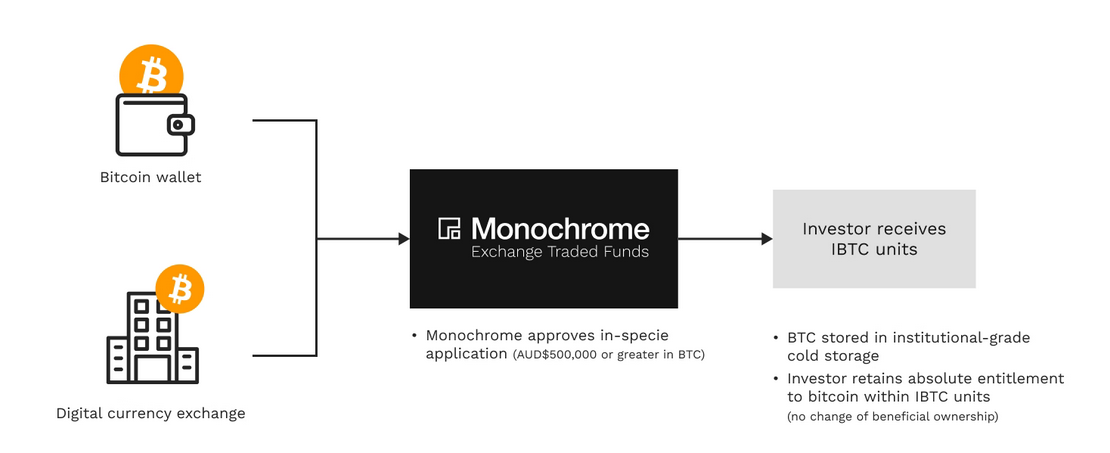

For eligible investors who apply to the Monochrome Bitcoin ETF in-specie from July 15, 2024, a full management fee rebate will apply until Dec 31, 2024. To be eligible, the investor must invest the minimum in-specie investment amount of AUD $500,000 equivalent in BTC.

Diagram: Simplified in-specie application flow for the Monochrome Bitcoin ETF (IBTC)

IBTC Management Fee Adjustments

This strategic adjustment reflects Monochrome’s commitment to supporting investor growth and accessibility, providing broader access to regulated Bitcoin products.

From July 15, 2024, the management fee for the Monochrome Bitcoin ETF (Ticker: IBTC) will be adjusted from 0.98% p.a. to 0.50% p.a. Please note that brokerage fees and commissions may apply, refer to your broker for details.

IBTC Adviser Program

In addition, Monochrome is proud to introduce the IBTC Adviser Program. Beginning July 15, 2024, Australian wholesale investors who subscribe to IBTC through an eligible financial adviser will enjoy a 0.29% fee rebate on the management fee.

“We consistently listen to our clients and understand the importance of a high-quality bitcoin product to align with their investment objectives and needs, and there is a gap when it comes to advised clients,” said Jeff Yew, CEO of Monochrome Asset Management.

“The IBTC Adviser Program underscores Monochrome dedication to providing investment opportunities that meet the needs of our investors. We believe this move will help strengthen trust among advisers and their clients in conversations relating to Bitcoin and their digital asset strategies.”

Financial advisers will need to pass an accreditation program from Monochrome Research to qualify for the IBTC Adviser Program. A yearly adviser accreditation fee applies. For more information about the IBTC Adviser Program, please contact investor-services@monochrome.co.