Block Earner rockets past $9 million in crypto-backed loans with Aussie-first product

Leading blockchain-powered fintech Block Earner today officially launched its Aussie first crypto-backed loans out of beta, enabling crypto owners to release liquidity using their digital assets without selling them. People are lining up in droves with more than $9m of loans awaiting application, backed by more than $33 million in cryptocurrencies, giving Aussies a better way to build their home deposit, purchase a car or consolidate their debt without selling their crypto portfolio.

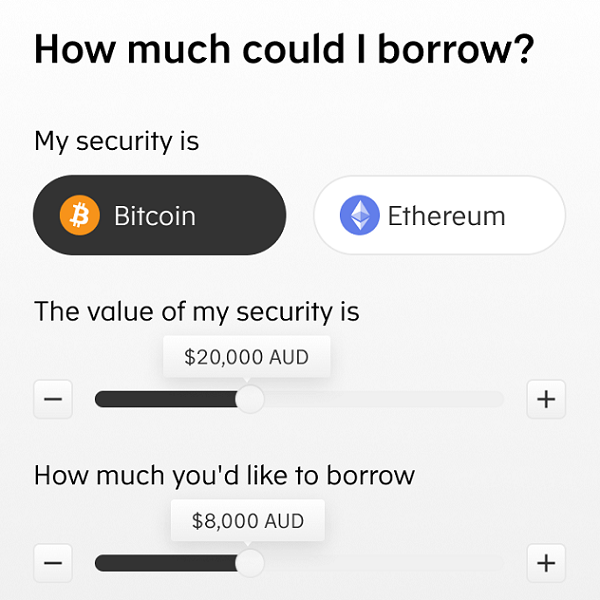

Crypto-backed Loans by Block Earner enables everyday Aussies to use crypto as security with a 33% loan-to-value ratio (LVR). Loans are written with competitive rates — Ethereum-backed loans cost 4.95% per annum, while Bitcoin-backed loans cost 6.95% per annum, both loans attract a 1% origination fee. Similar products exist in other regions of the world through Coinbase in the US and Nexo in the EU, but Block Earner is the local solution offering the product with an Australian Credit Licence Authorisation and with AUD denominated offering.

There are over 4.6 million Australians who own crypto in 2023, who have seen the value of their digital assets fall in the past 18 months after macro economic factors have affected both traditional finance and crypto markets. Conversely, many crypto users have experienced significant growth in their asset values. However, all crypto owners, avoiding realising their losses or gains, are now sitting on their digital assets waiting for the market to recover.

The need for liquidity to cover increasing living expenses is also becoming more evident, with inflation at its highest level in 30 years, interest rates at their highest levels in over a decade, and Australian savings levels dangerously low. Millennials and Gen Zs have a combined average of just $20,000 in savings, while homeowners are cutting back significantly to cover their mortgage repayments.

Charlie Karaboga, Co-Founder and CEO of Block Earner said, “Block Earner is the first blockchain company in Australia to provide groundbreaking crypto-backed personal loans, offered with an Australian credit licence authorisation, to crypto investors.

“We built this product because there’s a glaring need for it in Australia right now. 4 million crypto holders are going through a cost-of-living squeeze and are dipping into their savings or selling off their investments to free up cash. Now, however, we’re providing a way to free up cash without needing to sell their investments with a unique borrowing option that Australia has never seen before.”

More than half of Australian crypto owners (61%), equating to around 2.8 million Aussies, are considering using their crypto as security for loans in the next year to cover rising living expenses, Block Earner research indicates. Nearly a third (31%) of Aussie crypto holders say they’ll do so to cover unexpected emergency expenses — more than any other reason. 26% are looking into crypto-backed loans for home deposits and cars, while 23% are looking to pay off regular household bills.

Committed to remaining conservative in its approach, not only is collateralization limited to the most established coins on the market (Ethereum and Bitcoin), Block Earner’s loan-to-value ratio (LVR) for its newest innovative product is 33%, meaning customers are well-protected from large market moves. Customers also have the flexibility to pay their loan back in instalments or at the end of their loan period.

While there is a positive outlook towards crypto-backed loans during a time when volatility is at its lowest level since 2016, Block Earner’s research highlights potential concerns including future market volatility and possible loss of assets value. Block Earner addresses these concerns by offering a market-leading communication engine that alerts users across many touchpoints in the event of high volatility and setting an automatic repayment threshold of 70% LVR, which means the value of a customer’s crypto would have to drop by more than half to trigger an automatic repayment of the loan using the security. Critically, Block Earner only sells a portion of the security bringing the LVR down from 70% to 55%

As Australia’s first crypto-backed loans provider, Block Earner operates under an Australian Credit Licence Authorisation and is currently a member of the Australian Financial Complaints Authority (AFCA).