Five mistakes cryptocurrency investors make at tax time

Crypto Tax Calculator have revealed the 5 biggest mistakes Australian cryptocurrency investors make at tax time.

Coinstash partners with Syla to streamline tax reporting for private wealth clients

The partnership aims to streamline tax reporting for Coinstash’s individual investors, along with its private wealth clients, including SMSFs, Trusts, and Corporate entities.

Revolut enables its Australian customers to meet their crypto tax reporting obligations

Revolut opens the crypto customers’ access to an external tax reporting service at discounted prices.

Coinbase joins forces with CryptoTaxCalculator to help Aussie users take the cryptic out of crypto tax

Coinbase, has partnered with Sydney-based CryptoTaxCalculator (CTC) to help Aussie customers file their crypto taxes with confidence.

Koinly and Cointree announce partnership and industry-first functionality

Koinly and Australian crypto exchange Cointree have announced a partnership to make doing crypto taxes easier than ever.

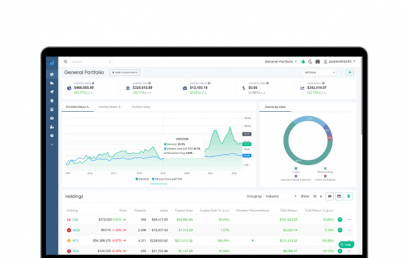

Portfolio tracking platform Navexa partners with BTC Markets with crypto tax reporting solution

Navexa has partnered with BTC Markets to deliver advanced crypto tax reporting to the exchange’s Australian customers.

Australians at risk of missing out on estimated $1.1B in eligible working from home deductions

TaxFox, a new personal finance app that helps users maximise tax refunds, reveals Australians are at risk of missing out on working from home deductions.