BetaCarbon Launches First Platform Enabling Australians to Invest in Australian Carbon via Blockchain

Today BetaCarbon launched its platform to allow Australians to diversify their investments by participating in the Australian carbon market.

The multi-award winning fintech was founded last year to democratise access to the Australian carbon market, allowing individual and small business investors to ride the wave to net zero.

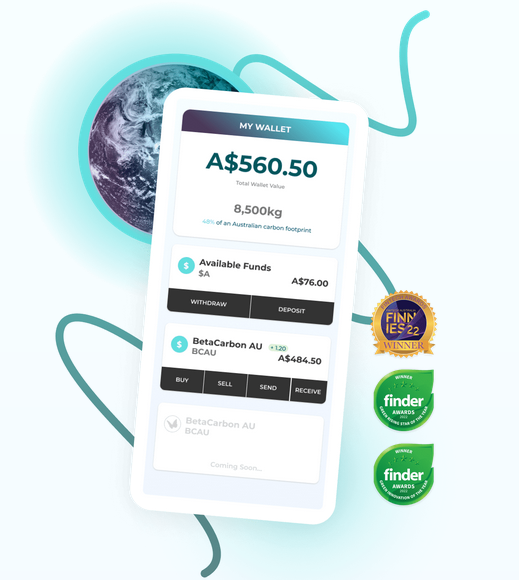

To date retail investors were unable to directly invest in Australian carbon credits, but BetaCarbon purchases and then tokenises Australian Carbon Credit Units (ACCUs) so that consumers can invest in its Australian Carbon Token (BCAU) from $1. One token represents 1kg of CO2 emissions captured or avoided.

Demand for carbon credits is rising rapidly, with the world decarbonising and 54 of the ASX 100 companies having pledged net zero by 2030. Q1 2022 saw a 62% YOY increase in Australian carbon credits voluntarily ‘cancelled’, the process by which the purchaser of a carbon credit claims it as an offset so that it cannot be resold.

BetaCarbon CEO and Founder Guy Dickinson said, “The Australian carbon market is maturing quickly as the federal government and the corporate sector alike ratchet up their commitments to decarbonisation. The price of Australian carbon credits has risen significantly in recent years, as more companies voluntarily seek carbon offsets to reduce their emissions. But still the ACCU is priced today at a mere fraction of its European Union and New Zealand equivalents.”

The company has already sold more than $4 million worth of tokens in its pre-launch phase, representing 93 million kilograms of captured carbon.

Dickinson said, “As the demand for Australian Carbon Tokens increases, so too will the demand for Australian carbon credits, as BetaCarbon purchases ACCUs to mint new tokens. The more demand for carbon credits, the higher the need for new green projects for businesses to offset.”

BetaCarbon attracted seed funding from several high-profile funds, among them Tribeca Investment Partners, Twynam Investments and Tectonic Investment Management.

Its advisors include Daniel Crennan, formerly Deputy Chair of ASIC, who said, “BetaCarbon proactively consulted early on with relevant regulators and I’m confident that its well-considered approach to the complex and dynamic regulatory framework in which it operates will stand it in good stead.”

BetaCarbon holds a wholesale Australian Financial Services Licence, which allows it to work with business customers seeking financial services related to carbon credits, including retiring credits for carbon neutral certification.

Last week BetaCarbon won Best Investment Innovation at the Finder Innovation Awards, with the jury applauding BetaCarbon for “giving access to a market that was previously difficult to access for the majority of investors [while] working to disincentivise emissions”.

This follows BetaCarbon winning the Green Innovation and Green Rising Star categories at the Finder Green Awards earlier this year, as well as the People’s Choice Award for an emerging fintech organisation at FinTech Australia’s Finnie Awards.

BetaCarbon’s Australian Carbon Tokens are built on the Ethereum network because of its energy efficiency, with the blockchain platform’s electricity consumption reduced by more than 99.9% since its ‘merge’ last month.