An Investor’s Guide to Good Government Stimulus

By Damien Klassen – Head of Investments, Nucleus Wealth

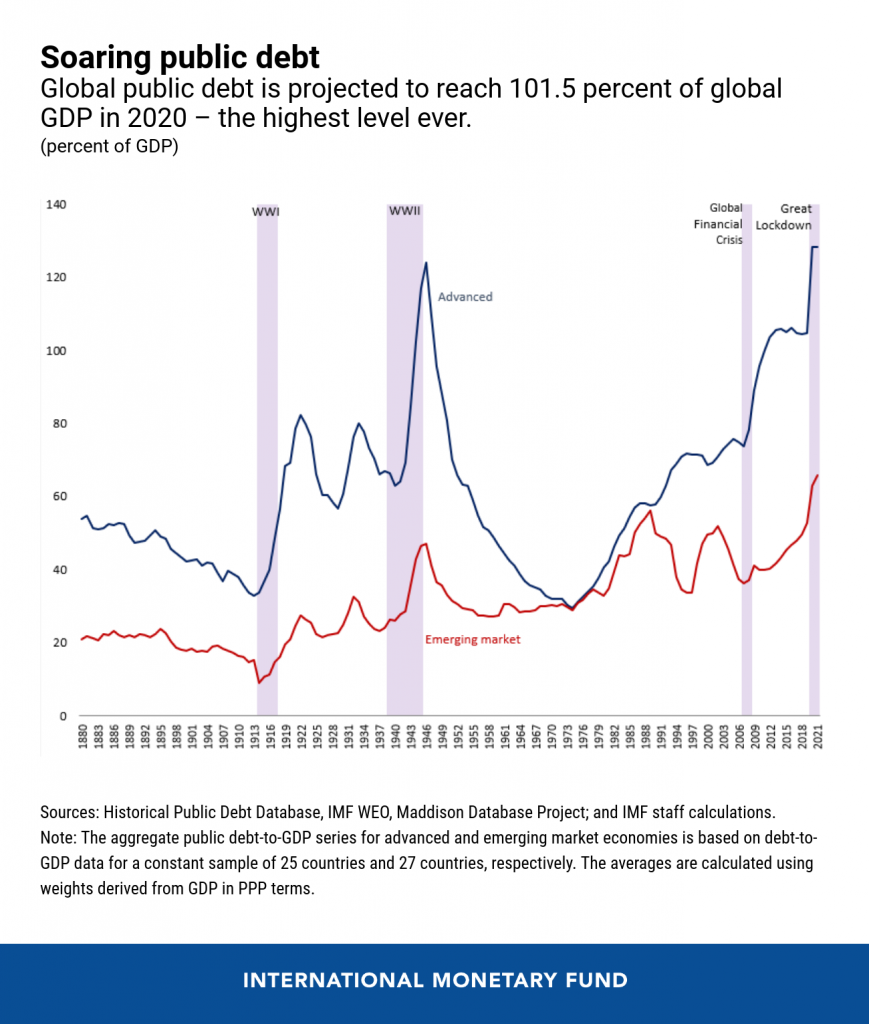

We are in a strange political environment. Globally there have been trillions of dollars of government stimulus announced, deficit hawks have turned chicken, and formerly staunch opponents of government intervention have been leading the charge. How should investors assess each government stimulus announcement?

One day the Australian government told us they had the right level of stimulus. The next they announced a miscalculation by a cool 3% of GDP but assured the public that the new level was also correct.

Which begs the question: in today’s world, is government stimulus ever wrong? Surely moar stimulus good / less stimulus bad for investment markets is too simple. Although some days it doesn’t seem like it.

There are a few different frameworks investors should examine stimulus through:

Government stimulus effect on factors of production

First, I want to take you back to the OG economists, Adam Smith, Ricardo, Marx. Let’s use a restaurant as an example of how they examine the factors of production:

- Land: the lease on the building

- Capital: Loans for the fit-out of the restaurant, or to the building owner to purchase the property.

- Workers: the waiting staff and chefs in the restaurant

- Entrepreneurs: the owner of the restaurant that took the economic risk to put it all together.

I’m going to extend this further. Let’s say we live in a country with only four industries: a factory, a restaurant, a bank and a grocery store. And coronavirus hits. The restaurant is deserted and running at a loss, with the owner staring at bankruptcy.

The question is, who is going to bear the brunt of the economic pain?

- Land: The restaurant could have a considerable rent reduction. The downside is that the landowners will suffer, and might go bankrupt. But even if they do, another landowner would step in (at a reduced price), and our overall economy would still be OK with everyone employed. i.e. bad for an individual landowner, OK for the economy.

- Capital: The restaurant could stop paying interest to the bank and maybe write down some debt. The downside is the bank will suffer, and won’t lend to others. But again the immediate economic impact is relatively low if most remain employed.

- Workers: We can fire a bunch of workers in the restaurant. The downside is that with no money, the workers don’t spend on goods from the factory and reduce their grocery spend. Because of this, the factory has the same problem, and need to lay off staff. Which results in even less demand for the restaurant and the grocery store and a negative economic spiral ensues.

- Entrepreneurs: We could send the owner bankrupt. The problem here is you might end up with no restaurant, all of the workers fired and the same issues as above. The landlord is stuffed: it might be years before another entrepreneur opens a new restaurant. Plus our factory workers, grocers and bankers now have nowhere to eat out. And restaurants don’t own many assets, and so the banks might not get much back.

Net Effect: Through this lens, the government stimulus targeted to help entrepreneurs and workers at the expense of capital and land will be less disruptive. I’m not making a moral judgement here about who “should” bear the pain. Just about which government policies and stimulus will have a more effective short term economic impact.

To read more, please click on the link below…

Source: An Investor’s Guide to Good Government Stimulus | Nucleus Wealth